- Huawei offers small batches of older AI chips to the Gulf and Southeast Asia.

- Huawei moves early to enter Nvidia-heavy markets ahead of US export curbs.

Huawei is quietly trying to sell small batches of its AI chips to countries in the Middle East and Southeast Asia, Bloomberg reported. The goal is to get a foot in the door in markets where Nvidia dominates — even as Huawei faces limits on how many chips it can make.

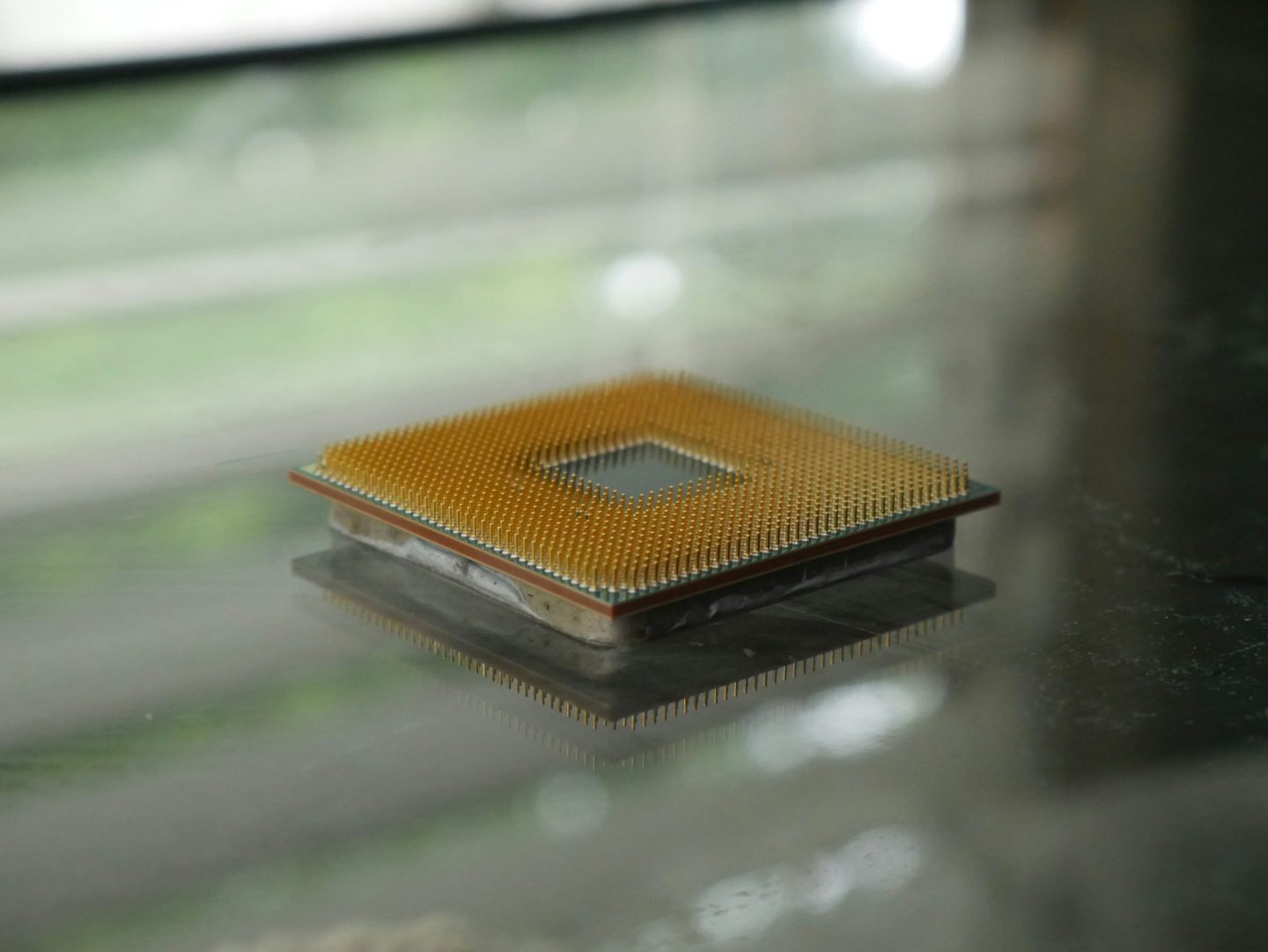

Sources familiar with the situation say Huawei has approached potential buyers in the UAE, Saudi Arabia, and Thailand to offer its older Ascend 910B processors. Both Gulf nations have already signed large, multi-year deals to buy chips from Nvidia and AMD. Thailand also relies heavily on Nvidia for its AI work.

Huawei is offering thousands of 910Bs, though exact numbers vary depending on the pitch. It’s also trying to interest buyers by giving them remote access to a more advanced AI system called CloudMatrix 384. That system runs on Huawei’s newer Ascend 910C chips, which it isn’t exporting yet due to tight supply. Those newer chips are mainly being reserved for customers in China that can’t buy US chips.

So far, no deals have been finalised. But insiders say the effort shows Huawei wants to get its AI hardware in front of foreign buyers while it works to ramp up production. Washington is paying close attention too, as US officials push for American-made tech to be the foundation of future AI systems. Huawei’s own estimates — and those from the US — suggest its Ascend chips are still at least a generation behind Nvidia.

Moving old chips before they lose value

Part of the urgency may come from Huawei’s inventory. The company reportedly stockpiled nearly 3 million Ascend 910B dies from Taiwan’s TSMC before export controls tightened. Moving this older stock now allows Huawei to recover value before the chips become outdated — and gives it a chance to gather feedback from early adopters before newer chips like the 910C and 910D are ready to scale. It also helps Huawei quietly establish itself in regions where US chipmakers have a strong grip.

In the UAE, interest has been low. People familiar with the matter say even institutions like the Mohamed bin Zayed University of AI haven’t shown much enthusiasm. Thai officials didn’t respond to questions, and the status of talks there remains unclear.

Huawei has also been in talks to supply about 3,000 chips to Malaysia, according to earlier reports. The status of that project isn’t known. In Saudi Arabia, conversations with government-linked groups like the Saudi Data & AI Authority (SDAIA) appear to be more advanced. However, a SDAIA spokesperson said they couldn’t comment because it’s not currently within their scope.

Gulf nations invest in AI infrastructure

The Middle East, especially the Gulf, is fast becoming a hotspot for AI development. Saudi Arabia is backing its AI efforts through the Public Investment Fund and SDAIA, building new infrastructure and university programs tied to its Vision 2030 goals. In the UAE, MBZUAI has launched new partnerships with international research institutions and rolled out its own large language models. The region is positioning itself as a home for sovereign AI systems, drawing interest — and competition — from both Washington and Beijing.

One former US official said Huawei can only produce about 200,000 AI chips this year, mostly for customers in China — where demand is over one million units. That number doesn’t include the 2.9 million older chips Huawei stockpiled from Taiwan’s chipmaker TSMC.

But US officials aren’t taking much comfort in those numbers. Commerce Under Secretary Jeffrey Kessler told lawmakers that China’s limited output doesn’t mean it lacks global ambitions.

Huawei declined to comment on these efforts, which are based on conversations with several sources who asked not to be named. The company previously said it hasn’t shipped Ascend chips to Malaysia. Malaysian officials have also distanced themselves from the reported deal.

The US is paying close attention to AI infrastructure deals in the Gulf and Southeast Asia, in part because of those regions’ strong relationships with China. Washington has urged countries to avoid Huawei chips and offered US alternatives, though those come with strings attached — and those conditions are still being sorted out.

That balancing act is especially visible in Southeast Asia, where countries like Malaysia and Thailand are trying to stay neutral. Malaysia is home to major chip assembly and testing operations and is now attracting investments to support AI data centres. Penang, in particular, is drawing interest from global players like Intel and Infineon. While these countries rely on the US for high-end technology, they also have long-standing trade ties with China — making them cautious about taking sides in the tech standoff.

US delays new export controls

Back in May, the Trump administration announced plans to change how export rules are handled, but disagreements inside the government have slowed that process. The Commerce Department has written a draft rule that would extend export controls to Malaysia and Thailand, but it hasn’t taken effect. It also wouldn’t fully replace the earlier rules set under President Biden.

At the same time, the Commerce Department hasn’t approved chip sales tied to Trump’s recent trip to the Gulf, which included AI deals worth billions. US export rules already require licenses for AI chip sales to the UAE, Saudi Arabia, and others since last year. Nvidia declined to comment, and AMD and the Commerce Department didn’t respond.

Some Trump officials believe Huawei’s chip offers make it more urgent to approve US sales now. They say the risk is that Huawei will build relationships now and ship more chips later. Others argue there’s no need to rush — and that selling too many chips could still benefit Beijing. They believe Nvidia’s dominance gives Washington the upper hand to set strict conditions.

In their view, the fact that Huawei is only offering a few thousand older chips, and not its best ones, is a sign that the US still has time to act carefully.

In Saudi Arabia, where one government-backed AI fund has said it would drop China ties if asked by the US, Huawei has worked closely with local groups on AI. But it’s unclear whether that will lead to a chip deal — or how Washington might react if it does.

Ongoing trade restrictions still apply

Earlier this year, the Commerce Department warned that using Huawei’s Ascend chips anywhere in the world could violate US rules, since the chips rely on American tech. After pushback from Beijing, the US dropped that specific language, though it still warns that unlicensed use of Ascend 910B, 910C, or future models like the 910D could lead to penalties.